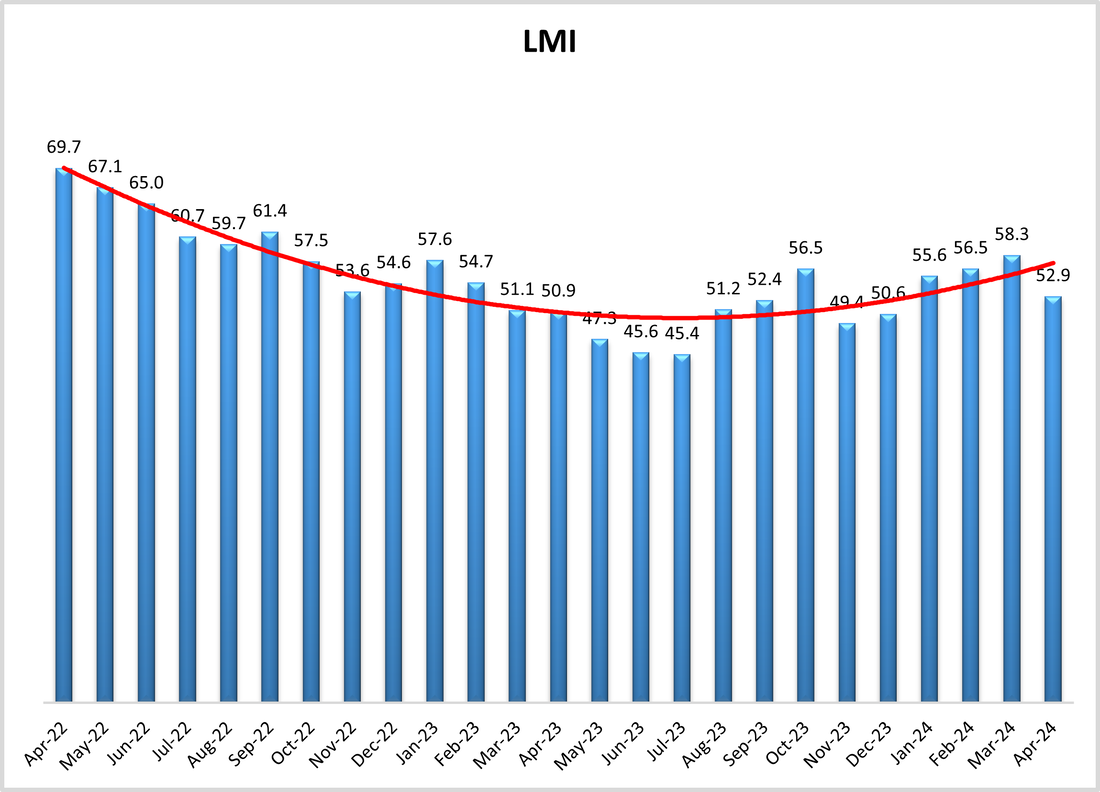

Logistics Managers Index Tumbles In April, After Consecutive Months Of Growth

The Logistics Manager's Index (LMI) cooled down a bit in April, registering at 52.9. This is a 5.4 point drop from March's reading, which was the peak growth rate in a year and a half. While it's still positive territory, it marks a break from the four-month streak of rising growth rates and is the slowest expansion we've seen this year.

Inventory levels took a significant dive (down 12.8 points to 51.0), which is the weakest level of expansion we've seen. Lower inventory led to looser capacity in both warehousing (up, but by a smaller margin) and transportation (a slight increase).

Warehousing utilization also grew at a slower pace, and most importantly, transportation prices are back in contraction territory at 44.1.

We had seen signs of the transportation market getting back on track, but these metrics paint a different picture. Transportation capacity is now a whopping 17.3 points higher than transportation prices (61.4 vs 44.1), which tells us we're still stuck in a freight recession.

But, the industry showed some resilience in the latter half of April, particularly in transportation. Prices jumped back into expansion territory (up 27.3 points to 54.8) and capacity dipped (down 10.1 points to 57.4) during that time.

Image: Transportation Movements From Early March To Late April, the LMI.

Transportation capacity (the orange line on the chart), continued to climb in April, reaching a healthy 61.4. We track this metric alongside transportation prices (the green line) to gauge imbalances between supply and demand.

Early April's slowdown caused a worrying gap between the two, with capacity a whopping 40 points higher than prices. This kind of spread would typically signal a deep freight recession. Thankfully, the late-month surge narrowed that gap considerably, bringing them within 2.6 points of each other.

For the freight recession to truly be over, we'd need to see a sustained period where prices rise faster than capacity. While April's late surge was a positive sign, we're still far from a boom market.