ACT Research Shows Trucking Capacity Contracts as ELP Enforcement Tightens

ACT Research’s latest For-Hire Trucking Index offers one of the first deep dives into the trucking market since the FMCSA began stricter enforcement of English Language Proficiency (ELP) standards — and the early signs are clear: capacity is shrinking fast.

ACT Research’s latest For-Hire Trucking Index offers one of the first deep dives into the trucking market since the FMCSA began stricter enforcement of English Language Proficiency (ELP) standards — and the early signs are clear: capacity is shrinking fast.

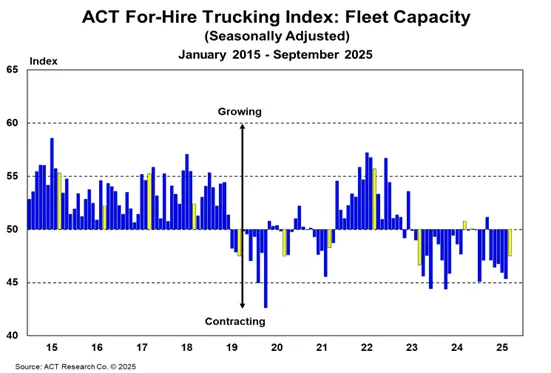

In September, ACT’s Capacity Index climbed 2.1 points to 47.5, signaling that for-hire capacity is still contracting. Analyst Carter Vieth noted a major contributor — a 32% drop in tractor builds from the first half of the year to the second. That cut pushed production below replacement levels, tightening equipment availability across the market.

But tractors aren’t the only thing in short supply. The FMCSA’s tougher ELP enforcement could reduce the driver pool by as much as 10%, disproportionately affecting the lower end of the spot market where many freight brokers operate. If that happens, smaller carriers could be squeezed the hardest, amplifying the capacity crunch.

Demand’s There… Kind Of

On the demand side, the picture’s murkier. The Volume Index rose to 55.1 in September — its highest level in more than a year — hinting at improving freight activity. But Vieth cautioned that “volumes are tricky to parse in the near term,” with consumer spending still propping up inventories while manufacturing and housing remain sluggish.

Risks still lean to the downside. Slowing income growth, tariff pressures, and uneven spending patterns could limit any real rebound. The good news? Inventory levels aren’t bloated, meaning we’re unlikely to see another painful 2022–2023-style destock cycle.

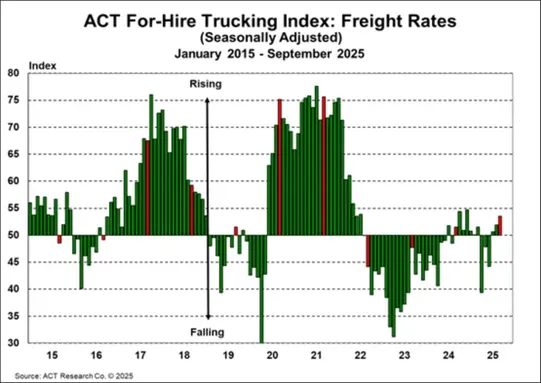

Rates Aren’t Moving Like You’d Expect

Despite all the talk of shrinking capacity, rates haven’t taken off. The Pricing Index rose just 1.6 points to 53.5, with spot rates up a modest 1–2% month-over-month. With inflation still running near 3%, most carriers aren’t seeing meaningful margin expansion.

As Vieth summed up, “If capacity continues to contract and the economy grows — even modestly — we could see for-hire demand recovery by mid-next year.” Add in potential relief from interest rate cuts, and durable goods and housing demand might start to reheat heading into late 2025.

The Bottom Line

Capacity is tightening, but demand and pricing are lagging. Between regulatory shifts, slowing tractor builds, and tariff-driven costs, the trucking market is entering a strange in-between zone — one where both rate hikes and volatility can coexist.

For brokers and carriers, that means the next few months could be less about chasing rate spikes and more about positioning for when the fundamentals finally align.