Organized Crime Drives Record Q3 Freight Losses

CargoNet’s latest Q3 2025 analysis paints a clear picture: cargo thieves aren’t necessarily stealing more freight — they’re stealing smarter.

CargoNet’s latest Q3 2025 analysis paints a clear picture: cargo thieves aren’t necessarily stealing more freight — they’re stealing smarter.

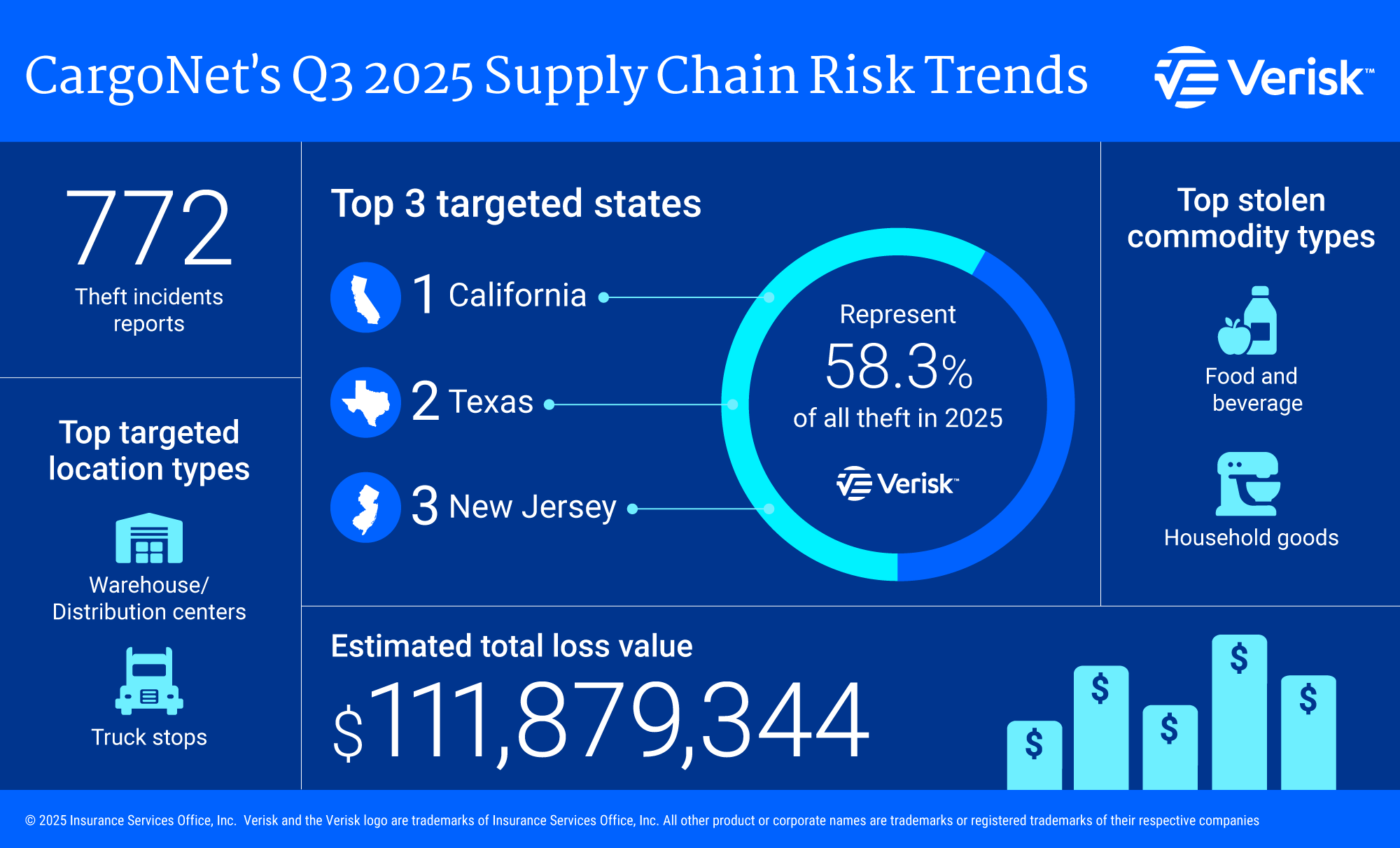

The Verisk-owned cargo theft prevention network recorded 772 cargo thefts across the U.S. and Canada in Q3 — just a 1% increase year-over-year and down 10% from Q2. But while theft frequency leveled off, the value of stolen goods shattered records, hitting $111.9 million for the quarter.

The average loss per event? $336,787 — double last year’s number. Organized crime groups are honing in on high-value and ultra-high-value loads, including enterprise computer hardware, crypto mining rigs, and copper.

The New Hotspot: NYC Metro

California and Texas still lead the pack in total thefts, rising 11% and 12% YoY, but the real surge is happening in the New York City metro area.

New Jersey saw a 110% jump in thefts, while Pennsylvania climbed 33% — a sign that organized crime is shifting eastward.

“The NYC metro area is emerging as both a primary location for theft activity and a destination for stolen goods,” said Keith Lewis, VP of Operations at CargoNet. “Organized groups are exploiting the region’s dense logistics network and proximity to major consumer markets.”

Criminals Are Recalibrating

CargoNet’s analysts note that organized crime groups are adapting — not retreating. Some are ditching complex frauds like proof-of-delivery scams in favor of simple, direct trailer thefts, particularly in Southern California, the Bay Area, Phoenix, and Lake Tahoe.

Others are moving in the opposite direction: refining digital deception. Instead of targeting the tender phase — where most anti-fraud tools are focused — they’re infiltrating later in the process, impersonating verified carrier contacts to redirect legitimate loads mid-transit.

These groups are using advanced social engineering to gather details such as:

- Which brokerage is managing a shipment

- The assigned carrier

- The names and contact info of key personnel

Armed with this data, they’re convincing enough to reroute freight without ever being tendered.

CargoNet expects these tactics to accelerate in Q4 as bad actors scrape public load boards and industry databases for intelligence on high-value shipments.

What They’re Stealing

While electronics and metals remain lucrative, food theft is quietly exploding.

- 🥩 Meat and seafood thefts: up 189% YoY (18 → 52 events)

- ⚙️ Copper thefts: up nearly 5x (10 → 47 events)

- 🧃 Food & beverage: led all categories with 170 thefts

- 🪑 Household goods: 92 events

- 🔩 Metals: 65 events

- 🎮 Games and toys: rising ahead of the holidays

High-value tech shipments — like enterprise servers and crypto hardware — are also being targeted more aggressively, often disguised as routine dry van freight.

The Big Picture

Theft volumes may have steadied, but the sophistication and selectivity of organized crime are rising fast. Cargo thieves are learning, adapting, and earning more per hit — and the ripple effects for brokers, carriers, and shippers are only growing.

As CargoNet’s Lewis summed it up:

“As criminal tactics evolve, so must our collective defense. This challenge requires industry-wide collaboration, information sharing, and a commitment to staying ahead of emerging threats.”

CargoNet urges stakeholders to report thefts to law enforcement first, and only then to CargoNet once safety is ensured.